Overview

- Everything you need to know about tax rate in Ocerra with examples.

- Using default tax rate, annotating rate value, using different rates on different lines, calculating a non-standard tax rate (e.g. for financial services).

General information

Tax rates (codes, types, and rates) are synced from your system to Ocerra. You can find it under Settings & Name of your integration, e.g.:

- You can view, calculate, re-calculate or manually update tax rates on the invoice before posting to your system from your existing list of tax codes/rates.

On the header level, Ocerra uses information from the invoice to populate the tax rate value:

On the line level, Ocerra populates all the lines with the default supplier rate, if it is not found, it will use a default Tax Account rate instead:

Annotating missing value on the invoice

If GST value is on the invoice, but Ocerra didn't populate it, use value-based annotation:

- Click on the empty GST value first, then click on the GST value on the invoice and Save.

- After saving, Ocerra will remember your annotation for this invoice layout.

Adding missing value to the invoice

If Total and Net values are on the invoice but GST value is missing (a very rare use case), then on the header level:

- Click on the icon next to the GST field and select the first option (Total - Net) on the list and click save.

- Ocerra will calculate it for you using Gross = Net + Tax formula.

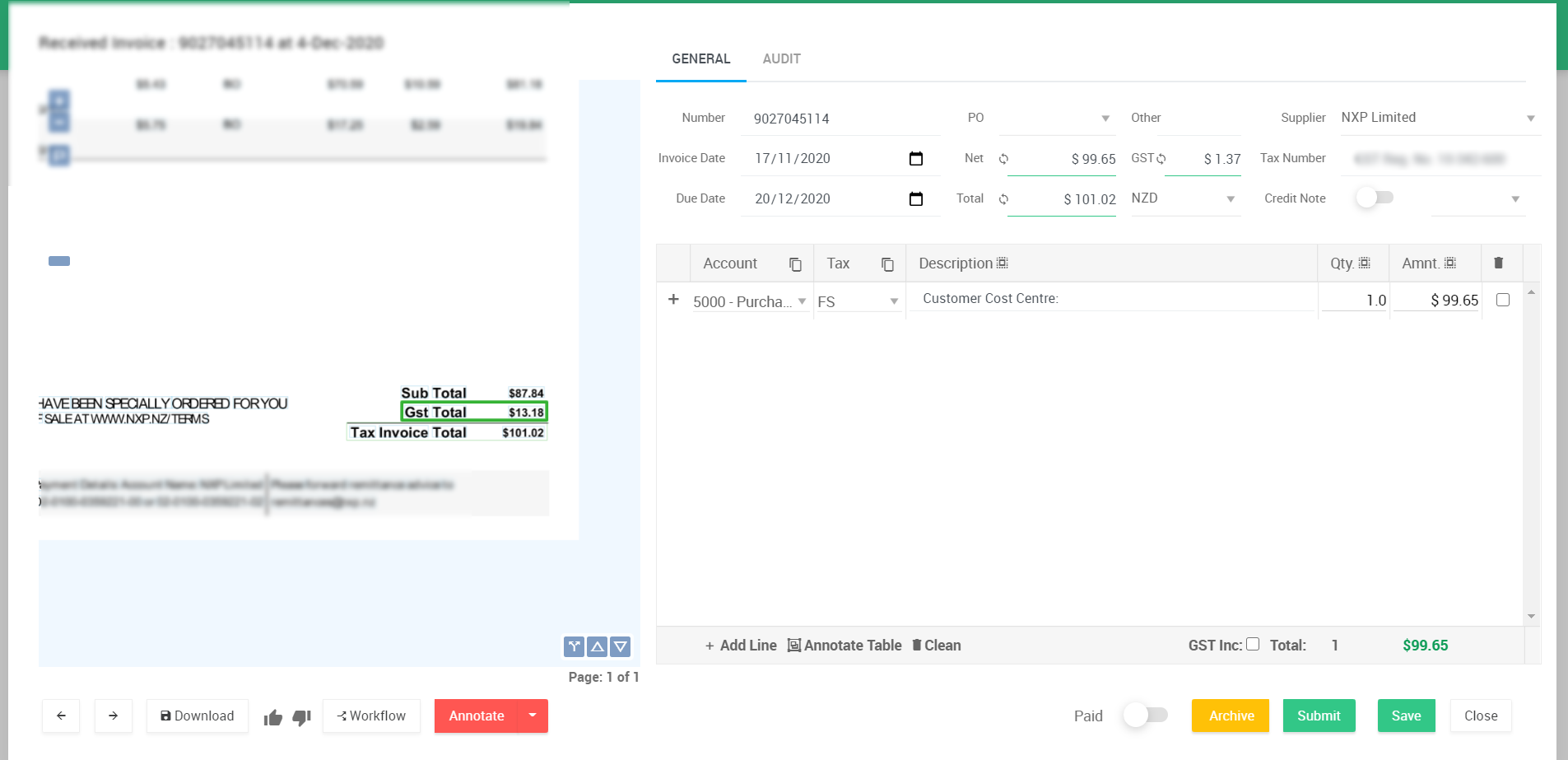

Calculating a non-standard tax rate

If you have to apply a different tax rate on the invoice and re-calculate existing Net and Tax values, you can do it by clicking on the icon next to the GST value and selecting your tax rate from this list (see above).

Ocerra will use the formula: GST = Total - Total / (1 + GST Rate) and will re-calculate Net and Tax values on the header level and line level.

Important: if you have more than one line on the invoice, this calculation will summarize it into one line.

This is how it will look after you click "Ok" - ignore the "Annotate" button and click "Save":

What to do if invoice lines have a different tax rate?

A situation where a supplier has more than one tax rate on an invoice. For example, a DHL invoice might have one line as GST Zero-rated and another line with GST 10%:

By default, Ocerra will populate all the lines using the default supplier tax rate. If in the example above a DHL supplier is set with GST 10% in your system, Ocerra will use this rate on all the lines.

- You will need to manually update Tax Rate on the required change line(s) and click "Save" before posting to your system:

How to quickly identify that populated data is not matching on the invoice?

The amount at the bottom will be highlighted in red if the information on the header level doesn't matches with the information on the line level. By hovering the mouse over it, you will be able to see the difference between header and line level calculations. For example (On the header level Tax is $19.50 and on the Line level Tax is $0.00), as a result, the total is not matching:

You will have to adjust the tax type on the line(s) to make it match, it will give you a "green light" to post to your system: